Each year, marketing/product/sales leaders lay out plans for how their functions will drive efficient incremental growth for their startup during annual planning. They also ask finance for a big chunk of capital to fund that plan in the form of headcount, ad dollars, engineering resources, etc. Its finance’s job to make sure dollars are spent wisely; the challenge for them is that most team’s proposals are not grounded in realistic plans and assumptions for them to engage with. Thus, they have to trust the leader’s “instincts”.

So, as a leader, how do you show that your plan is more robust and credible than your peers and get the resources you need? Alternatively, how do you as a CEO hold your team accountable to rigorous planning? The answer is to use two-variable sensitivity analyses for modeling the success of growth initiatives that the company will rely on.

In this post we’ll walk through what a two variable sensitivity analysis is, what happens when you don’t use it, and a more detailed example + template for you to utilize.

Your new best friend — the two variable sensitivity analysis

To make a credible case to leadership you need a two variable sensitivity analysis.

A two variable sensitivity analysis is the equivalent of a turbocharged “What If” analysis for growth initiatives or forecasts. The analysis allows you to identify multiple paths to growth by projecting how changes in specific variables, like feature adoption rates or user engagement, can lead to different outcomes—essentially giving you a roadmap of options that guide your strategy like a GPS for growth.

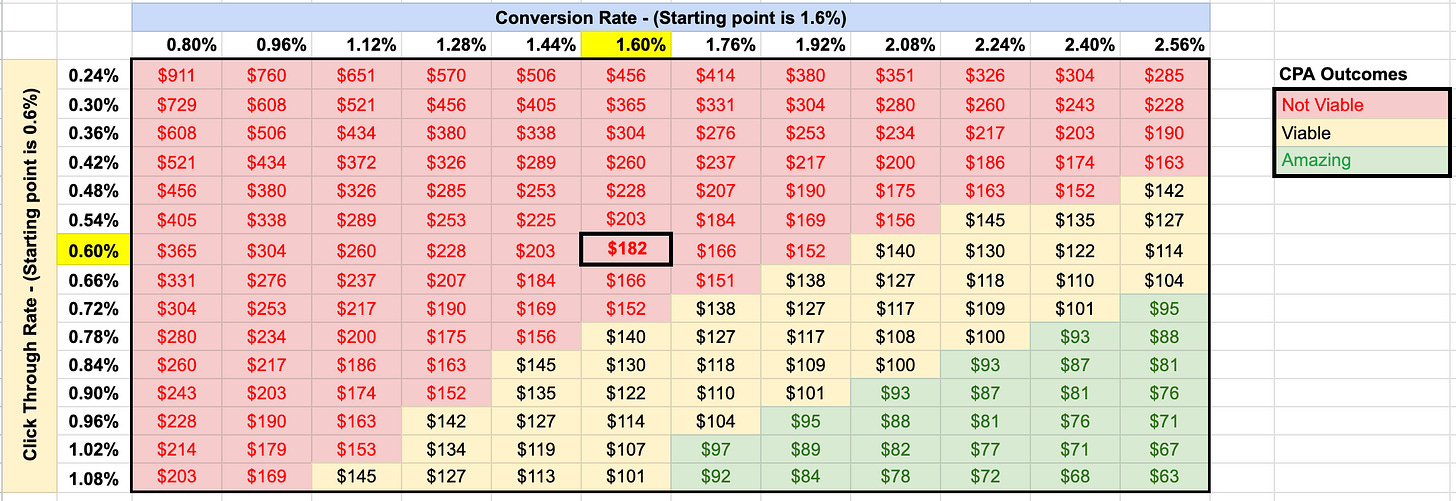

Here is an example from a growth marketing team focused on scaling facebook ads. We’ll walk through it in more detail later.

In a nutshell, the analysis shows leadership 2 things:

The key constraint that the plan hinges on - these are the color coded values in the middle of the table (in this case cost-per-acquisition)

How much the key optimization levers need to change - The two axes of the table (in this case click-through-rate and conversion rate)

This represents all the quantitative paths to success, or in this example all the CTR & CVR combos that result in viable CPAs. Your job as a leader is to build a model, identify the key constraint of the model, and build a sensitivity around that constraint using the two key variables that most directly influence it.

Note: the most credible growth initiatives hinge on levers you can improve; non-credible plans hinge on external variables.

Lets walk through two hypothetical growth marketing teams pitching their initiatives in annual planning

The scenario: The proposed operational plan is to scale paid social ads by 5x next year and the team’s key restraint is to maintain the same cost per acquisition (CPA) as the current year. They build a financial model showing spend, CPA, and user growth scale each month.

The average growth team would…

Stake success on this simple forecast - the forecasts represents the ONE PATH they are banking on—a snapshot with a bunch of assumptions behind it. Even worse, some teams might just use finance’s growth model!

Reliance on “trust” for green lighting - The CEO either trusts the team’s ‘gut’ on the projects or they don’t. It’s rarely an evidence based discussion. If trust is not there then neither is the resourcing

If they do get resourcing based on trust - the team ends up with little wiggle room to iterate. Since the model they presented has one path to success there is little patience if the team is off-track from the snapshot they put forward. Its hard to explain the why and bring leadership along the journey

If the plan is off-track - resources get cut, executive trust erodes, and the company misses targets

The better growth team would use a sensitivity analysis:

Step 1. They lay out the assumptions underlying the initiative’s growth forecast and highlight that CVR and CTR are the key variables they can influence

Step 2. They call out what assumptions they can’t influence and make that main assumption conservative. In this case they set ad rates (eCPM) to increase by 80% because of scaling spend and industry comps

Step 3. They identify the key constraint (CPA) which is a math formula based on eCPM, CVR, and CTR

Step 4. They show the multiple “math paths” to viable CPAs using their sensitivity table, with the starting point being the most current average ad CTR and CVR

Step 5. They show a plan to improve each variable by 50% (moving CTR from 0.60% - 0.84% and CVR from 1.6% to 2.24%) over the next 6 months through faster testing and better creative. Their supporting evidence is the best performing creatives and landing pages from the last 6 months

Step 6. They make a resourcing ask centered around systems and people needed to improve CTR and CVR. The conversation is focused around those two variables and proof that they can move them. Specifically the resourcing is for ramping up testing cadence and ad quality.

The benefits for everyone involved

There are multiple benefits to this approach:

Shows the margin of error baked into their plan. The table shows that if they improve just one lever by 40%, they can be completely wrong about the other. Or they can be partially wrong about both—even in scenarios where one metric gets worse!

Leadership can also play around and make the fixed assumptions (eCPM) more conservative - this allows for simplified dynamic pressure testing by changing one cell and all the color coding following

It creates a clear feedback loop for execution - when reviewing progress every month, the team can show which metrics are moving and what the updated paths to success look like. The focus of those discussions is ensuring there is always a viable path as they continue to execute or change the plans based on new insights

The Takeaway:

Startup teams need resources to accelerate growth. Making the most credible case for those resources is more important than ever as capital constraints continue. A two variable sensitivity analysis is how you get your team to be more rigorous in the plans they bring you and allow you to have a more dynamic conversation with them. Link here for the template. Respond in the comments of this Linkedin post if you are interested in more examples (e.g. product, sales, operations).